Can a shift to AR from Mobile devices trigger a new wave of value migration?

Augmented and virtual reality have been hyped for years with limited traction to date. Might that soon change? No one has a crystal ball, but it’s instructive to look at the potential through the lens of the patterns observed with other technologies. The bull case for AR and VR is that AR/VR glasses/headsets will be the next endpoint device.

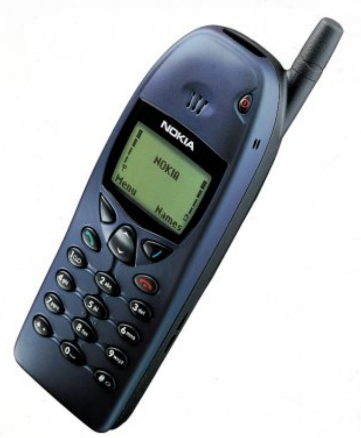

Back in 1995, most of us still primarily used a landline phone. A few of us had an underpowered PC that was still better at word processing than graphics. Online services reached through dial up modems were only starting to get traction. Cell phones were used by some of us, almost exclusively for voice calls, and still used sparingly because of the cost.

By 2015 the smartphone had supplanted the cell phone, the landline, and the PC to become the primary endpoint device, less for voice calls than for accessing a variety of online services that didn’t even exist ten years earlier. The landline had largely disappeared. The PC remained relevant, although much more so for office workers and serious gamers than across the broader population.

New Endpoint Devices Drove Huge Migration of Equity Value: The transition of endpoint devices from landlines and mobile phones to PCs and then smartphones has been central to the value migration over the past 25 years. Microsoft controls the PC with an OS market share exceeding 75 percent; Google, whose Android operating system is now running on more devices than any other OS, controls the smart phone with an OS market share exceeding 80 percent. Google initially developed its Android strategy largely to prevent Microsoft from gaining control of the mobile device OS. Apple has been the innovator in features and design, and it has carved out an extremely profitable segment with an integrated hardware/OS offering for mobile devices. Facebook owns the top mobile phone applications.

While Apple does earn large profits from its smartphone/OS bundle, Windows and Android are only moderately profitable. But they are an important strategic control point—the OS still plays a significant role in determining which services the device owner will use. Application stores are important for all vendors, and Office 365 is a huge profit driver for Microsoft. Advertising is the primary profit driver for Google and Facebook. These four companies have created more than $6.5 trillion in value, and are now 4 of the 5 most valuable companies in 2021. Only Microsoft was among the top 20 companies in 1995.

If AR/VR devices become mainstream a decade from now, they have the potential to disrupt to current dominance of some of these tech giants. It is not surprising that Apple is investing heavily in AR to protect its position, while Facebook and Microsoft are investing to establish control of AR and dislodge Apple’s and Android’s near-monopoly of the mobile devices that consumers rely on to access cloud services.

AR/VR Technology may be reaching the tipping point: 2020 saw a big step forward in VR headgear with the launch of the Oculus Quest 2, a self-contained headset with excellent positional tracking at a price point of $299. Late 2021 and 2022 are likely to see next generation AR headsets from Apple, Magic Leap, and other smaller players. While headsets will undoubtedly continue to improve, they are rapidly approaching the point of being usable by mainstream customers.

The attention is already shifting to the creation of “sticky use cases” for a range of market segments that will drive adoption and regular use of the extended reality headgear and demonstrate the ability of these technologies to disrupt existing markets. Spatial awareness (the use of machine vision and AI to provide context in environments), visualization of information rather than text, and voice interaction rather than touchscreen suggest that the experiences that compelling AR applications need to deliver will be quite different from a mobile device experience. Advertising, social, and online retail will remain central online services and will be greatly enhanced by AR/VR adoption. But the existing business models will need to evolve significantly, perhaps providing openings for new players.

Productivity Benefits may Accelerate Adoption: The connected desktop together with applications like Microsoft Office provided a huge driver of productivity for office workers. The smartphone has provided benefits to front line workers, but not to the same extent. AR/VR may become a key driver of enhanced productivity and safety for the 60% of workers who don’t sit behind a desk. Integrating geospatial, IoT, and other situationally relevant data into a handsfree workflow will be invaluable for workers ranging from salespeople to surgeons. As AR matures in its ability to seamlessly overlay information on the world as the individual experiences it, the boundaries between the app and the real world begin to dissolve. There will likely be new classes of services that have not yet been envisioned that will emerge as lightweight AR and immersive VR headgear becomes ubiquitous.

App Development Platforms: The number of enterprise AR/VR applications is still quite limited, and headset suppliers are concerned about the ongoing usage and engagement of their customers. Authoring in 3D and building use cases that integrate related services and capabilities such as voice control, location, machine vision, AI, and IoT data is still hard to do. Most enterprise dev platforms have not been designed to easily incorporate 3D visualization and other experiences required for AR/VR content. And while most game engines can create stunning 3D imagery, they are not designed to easily incorporate real time data from enterprise systems. Much of today’s mixed reality content is often created using a process resembling studio production of a game or film. Content costs can be hundreds of thousands of dollars per hour, even for relatively simple content. Many AR workflows will need to be customized for particular use cases, so authoring platforms need to be flexible and efficient and support short development cycles. The teams that will be using the AR workflows need to be active in creating and maintaining these AR applications. The provider of the platform that becomes “Office 365 for Mixed Reality” will accelerate this industry.

Future Value Flows: As technology has moved from phones to PCs, to the World Wide Web, to smartphones and new applications, trillions of dollars of value have been created. New entrants have typically captured much of this value while leading technology companies from the previous innovation cycle have seen value migrate away from them. Wide adoption of AR/VR can provide tremendous new value to front line workers as information becomes integrated into the world they experience. It also has the potential to devalue or displace the business models of today’s leaders.

It will be a while before we know which business models will most effectively establish control points that allow them to protect profitability in this emerging market. History suggests it will not be hardware or infrastructure, but the services that run on them, and possibly and the tools that allow efficient presentation of data for a wide range of individual use cases.

Interesting article published in the Wall Street Journal; June 27

The Apple-Microsoft Tech War Reignites for a New Era – WSJ